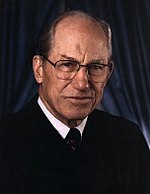

Byron White

Associate Justice of the Supreme Court of the United States and American football player (1917-2002)

Alan Greenspan, a renowned American economist, served as the 13th chairman of the Federal Reserve from 1987 to 2006. He was a private advisor and provided consulting services through his company, Greenspan Associates LLC. Greenspan’s tenure at the Federal Reserve was marked by both praise and criticism, with some arguing that his policies contributed to the dot-com bubble and the subprime mortgage crisis.

Table of Contents

Alan Greenspan is an American economist who served as the 13th chairman of the Federal Reserve from 1987 to 2006. He worked as a private adviser and provided consulting for firms through his company, Greenspan Associates LLC.

First nominated to the Federal Reserve by President Ronald Reagan in August 1987, he was reappointed at successive four-year intervals until retiring on January 31, 2006, after the second-longest tenure in the position, behind only William McChesney Martin. President George W. Bush appointed Ben Bernanke as his successor.

Greenspan came to the Federal Reserve Board from a consulting career. Although he was subdued in his public appearances, favorable media coverage raised his profile to a point that several observers likened him to a “rock star”. Democratic leaders of Congress criticized him for politicizing his office because of his support for Social Security privatization and tax cuts.

Many have argued that the “easy-money” policies of the Fed during Greenspan’s tenure, including the practice known as the “Greenspan put”, were a leading cause of the dot-com bubble and subprime mortgage crisis (the latter occurring within a year of his leaving the Fed), which, said The Wall Street Journal, “tarnished his reputation”. Yale economist Robert Shiller argues that “once stocks fell, real estate became the primary outlet for the speculative frenzy that the stock market had unleashed”. Greenspan argues that the housing bubble was not a result of low-interest short-term rates but rather a worldwide phenomenon caused by the progressive decline in long-term interest rates – a direct consequence of the relationship between high savings rates in the developing world and its inverse in the developed world.

Alan Greenspan was born on March 6, 1926.

Alan Greenspan served as the chairman of the Federal Reserve for 19 years, from 1987 to 2006.

Before becoming the Federal Reserve chairman, Alan Greenspan worked as a private advisor and provided consulting services through his company, Greenspan Associates LLC.

Alan Greenspan was first nominated to the Federal Reserve by President Ronald Reagan in August 1987 and was reappointed at successive four-year intervals until his retirement.

Greenspan’s ,easy-money, policies during his tenure were criticized as a leading cause of the dot-com bubble and the subprime mortgage crisis, which occurred shortly after his retirement from the Federal Reserve.

The longest tenure of a Federal Reserve chairman before Alan Greenspan was William McChesney Martin.

Ben Bernanke was appointed by President George W. Bush as the successor to Alan Greenspan as the chairman of the Federal Reserve.

To succeed, you will soon learn, as I did, the importance of a solid foundation in the basics of education – literacy, both verbal and numerical, and communication skills.

13th Chairman of the Federal Reserve in the United States

We need, in effect, to make the phantom ‘lock-boxes’ around the trust fund real.

13th Chairman of the Federal Reserve in the United States

The true measure of a career is to be able to be content, even proud, that you succeeded through your own endeavors without leaving a trail of casualties in your wake.

13th Chairman of the Federal Reserve in the United States

I don’t know where the stock market is going, but I will say this, that if it continues higher, this will do more to stimulate the economy than anything we’ve been talking about today or anything anybody else was talking about.

13th Chairman of the Federal Reserve in the United States

I was a good amateur but only an average professional. I soon realized that there was a limit to how far I could rise in the music business, so I left the band and enrolled at New York University.

13th Chairman of the Federal Reserve in the United States

Whatever you tax, you get less of.

13th Chairman of the Federal Reserve in the United States

History has not dealt kindly with the aftermath of protracted periods of low risk premiums.

13th Chairman of the Federal Reserve in the United States

Protectionism will do little to create jobs and if foreigners retaliate, we will surely lose jobs.

13th Chairman of the Federal Reserve in the United States

An almost hysterical antagonism toward the gold standard is one issue which unites statists of all persuasions. They seem to sense… that gold and economic freedom are inseparable.

13th Chairman of the Federal Reserve in the United States

Anything that we can do to raise personal savings is very much in the interest of this country.

13th Chairman of the Federal Reserve in the United States

In the absence of the gold standard, there is no way to protect savings from confiscation through inflation. There is no safe store of value.

13th Chairman of the Federal Reserve in the United States

I have found no greater satisfaction than achieving success through honest dealing and strict adherence to the view that, for you to gain, those you deal with should gain as well.

13th Chairman of the Federal Reserve in the United States

I’ve been in and out of Wall Street since 1949, and I’ve never seen the type of animosity between government and Wall Street. And I’m not sure where it comes from, but I suspect it’s got to do with a general schism in this society which is really becoming ever more destructive.

13th Chairman of the Federal Reserve in the United States

I guess I should warn you, if I turn out to be particularly clear, you’ve probably misunderstood what I’ve said.

13th Chairman of the Federal Reserve in the United States

Any informed borrower is simply less vulnerable to fraud and abuse.

13th Chairman of the Federal Reserve in the United States

Look, I’m very much in favor of tax cuts, but not with borrowed money. And the problem that we’ve gotten into in recent years is spending programs with borrowed money, tax cuts with borrowed money, and at the end of the day that proves disastrous. And my view is I don’t think we can play subtle policy here.

13th Chairman of the Federal Reserve in the United States