Am I a fool? I don’t think I’m a fool. But I think I sure was fooled.

Meaning of the quote

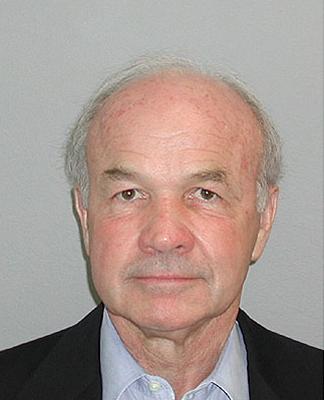

This quote suggests that Kenneth Lay, an American businessman, was uncertain about whether he was a fool or not. He seems to be saying that he doesn't believe he is a fool, but he also acknowledges that he was fooled or deceived in some way. The quote conveys a sense of confusion and self-reflection, as the businessman grapples with understanding his own actions and decisions.

About Kenneth Lay

Kenneth Lay was the founder and CEO of Enron, a company that became embroiled in a massive accounting scandal in 2001. Despite earning over $220 million between 1998-2001, Lay claimed his net worth was negative $250,000 at the time of his trial. Lay was found guilty of securities fraud but died before his sentencing, leading to a vacated judgment and conspiracy theories about his death.

Tags

More quotes from Kenneth Lay

But I can’t take responsibility for criminal conduct of somebody inside the company.

former chairman and CEO of Enron Corporation (1942-2006)

Any slots at the senior level, including CEO or other slots, will be filled internally.

former chairman and CEO of Enron Corporation (1942-2006)

We need someone who is a strong representative of our value system.

former chairman and CEO of Enron Corporation (1942-2006)

The last thing I would have ever expected to happen to me in my life would be that, in fact, I would be accused of doing something wrong and maybe even something criminal.

former chairman and CEO of Enron Corporation (1942-2006)

We use competitive markets to arrange for delivery of our food supply.

former chairman and CEO of Enron Corporation (1942-2006)

There are no accounting issues, no trading issues, no reserve issues, no previously unknown problem issues.

former chairman and CEO of Enron Corporation (1942-2006)

We see ourselves as first helping to open up markets to competition.

former chairman and CEO of Enron Corporation (1942-2006)

Trillions of dollars every day are being exchanged around the world in all of the financial markets.

former chairman and CEO of Enron Corporation (1942-2006)

You’d rather have a surplus versus a shortage in your position.

former chairman and CEO of Enron Corporation (1942-2006)

But the most important thing is, Enron did not cause the California crisis.

former chairman and CEO of Enron Corporation (1942-2006)

The transmission systems are still regulated.

former chairman and CEO of Enron Corporation (1942-2006)

You’ll have lower prices under deregulation than you will through regulation.

former chairman and CEO of Enron Corporation (1942-2006)

I take full responsibility for what happened at Enron. But saying that, I know in my mind that I did nothing criminal.

former chairman and CEO of Enron Corporation (1942-2006)

In the case of Enron, we balance our positions all the time.

former chairman and CEO of Enron Corporation (1942-2006)

They can’t do without electricity. They can do with less electricity.

former chairman and CEO of Enron Corporation (1942-2006)

We don’t break the law.

former chairman and CEO of Enron Corporation (1942-2006)

Our liquidity is fine. As a matter of fact, it’s better than fine. It’s strong.

former chairman and CEO of Enron Corporation (1942-2006)

Well, rates would go up whether you deregulate or not, and of course, the rates that are going up right now on the electricity side are still within the regulated framework.

former chairman and CEO of Enron Corporation (1942-2006)

The problems in California have been that it’s been very difficult to site and build new power plants.

former chairman and CEO of Enron Corporation (1942-2006)

I have to take responsibility for anything that happened within its businesses.

former chairman and CEO of Enron Corporation (1942-2006)

There are absolutely no problems that had anything to do with Jeff’s departure.

former chairman and CEO of Enron Corporation (1942-2006)

When there’s uncertainty they always think there’s another shoe to fall. There is no other shoe to fall.

former chairman and CEO of Enron Corporation (1942-2006)

Today, there are also buyers and sellers of all these energy commodities, just like there are buyers and sellers of food commodities and many other commodities.

former chairman and CEO of Enron Corporation (1942-2006)

But certainly I didn’t know he was doing anything that was criminal.

former chairman and CEO of Enron Corporation (1942-2006)

I don’t think I’m a criminal, number one.

former chairman and CEO of Enron Corporation (1942-2006)

But indeed a market like California is not good for Enron.

former chairman and CEO of Enron Corporation (1942-2006)

I mean, our primary businesses in wholesale pipelines, utilities, retail, were all doing extremely well.

former chairman and CEO of Enron Corporation (1942-2006)

Am I a fool? I don’t think I’m a fool. But I think I sure was fooled.

former chairman and CEO of Enron Corporation (1942-2006)

We’ve tried to get as much supply into California as we can.

former chairman and CEO of Enron Corporation (1942-2006)

I’ve been a strong financial and political supporter of, first, President Bush Sr. when he was running for president, and even when he ran for president a time or two and failed.

former chairman and CEO of Enron Corporation (1942-2006)

Every market is in transition.

former chairman and CEO of Enron Corporation (1942-2006)

Jeff knew full well what he was walking away from. Again, he needed to deal with this right away.

former chairman and CEO of Enron Corporation (1942-2006)

I have faith in the market when we get the rules right.

former chairman and CEO of Enron Corporation (1942-2006)

Investors don’t like uncertainty.

former chairman and CEO of Enron Corporation (1942-2006)